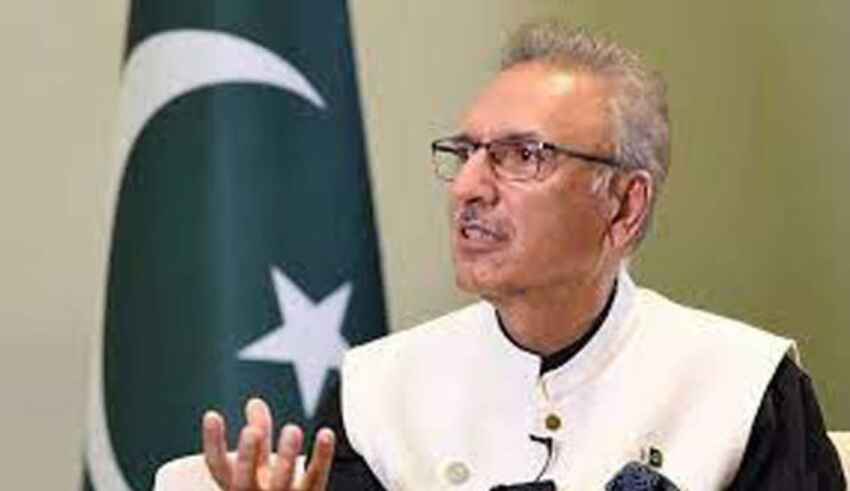

ISLAMABAD, Dec. 14, (INP-WealthPK)—President of Pakistan Dr Arif Alvi has highlighted the need for increased coverage of the agricultural sector under insurance policies to meet the regional level.

He expressed this desire during a meeting on crop insurance organized by the Federal Insurance Ombudsman (FIO) in Islamabad.

The President said that crop insurance is necessary to fight food insecurity in the country, adding that in Pakistan it covers only 1% of the crops whereas in regional peers the average is around 4-5%.

He said that our students should be educated about agriculture sector and its problems through proper inclusion of chapters on the subject in Higher Education Institutions, especially on crop insurance, risk management, crop losses due to disease, pest attacks, drought, and manmade or natural disasters.

He called on the Higher Education Commission to develop a curriculum based on these recommendations after consultations with relevant stakeholders.

The President also highlighted the poultry sector and said that such industries should also be included under the insurance umbrella. He said that businessmen and industrialists should be made aware of the need to protect their industries against the threats of disease, extreme weathers and climate change.

He said, “we need to develop our agriculture on modern lines using innovative technologies like vertical farming, drip technology, weather-resistant seeds, and modern machinery. If we adopt modern methods, we will be able to increase our agricultural and livestock production manifold.”

He continued, “this will help us fight food insecurity in the country and generate food surpluses for exports.”

Arif Alive advised all insurance companies and stakeholders to launch a comprehensive campaign through the media to educate and inform the public regarding their products, their benefits and risks attached to them.

Talking about climate change the President said that the importance of insurance increases in face of the emerging challenges that we are going to face in the future. He said global warming and climate change will cause our glaciers to melt and affect our agriculture sector for the worse.

He said, “this emerging situation will have to be met with a coordinated policy from government, industry, services sector and the civil society. We need a well-thought out policy to mitigate the negative effects of changing climate.”

During the meeting the President was informed that a committee had been constituted under the aegis of the State Bank of Pakistan to look into the possibility of crop insurance for small and large farmers.

It was also revealed during the meeting that the Asian Development Bank (ADB) has allocated USD10 million for research and development purposes to increase food security in the country.

The ADB representative also informed that policy-based easy loans will also be given to farmers and assured the President that the Bank will look into the possibility of introducing crop insurance scheme for vulnerable crop-growers.

Officials from the national insurance company informed the meeting that they are undertaking a pilot project in Sindh province with PKR40 million seed money to survey the target area, understand crop patterns and set a baseline, and if due to any natural or manmade calamities or pest attack, the yield of the crops was below 80% of the normal, the farmers would be compensated for their losses.

The President lauded the effort and stressed the need to bring more stakeholders into this project, adding that there are many research and development funds available with international agencies which should be diverted to the project of crop insurance.

He said that all relevant organizations and stakeholders should set up dedicated departments to identify such funds at the international and regional levels and make efforts to divert them toward their products relating to crop insurance.

He also agreed to the idea of setting up an institutional framework at the national level with its own secretariat to take stock of the crops’ situation around the country.

He urged all the stakeholders to develop a national policy on crop insurance by factoring in experiences of the past, and setting up implementation goals on well-defined KPIs.

He also called for setting a timeline to achieve the objective of raising the level of insurance cover in the agriculture sector from the current level of less than 1% to at least 4-5%.